Deployment of Microsoft 365 E3 with Security, Compliance and Unified Management for 1,000+ Users.

About

Founded in 2010 in the United Kingdom, Metro Bank was the first new retail bank to emerge in the country in over 150 years. It disrupted traditional models with a customer-centric approach, offering branches open seven days a week and an omnichannel service experience. With rapid growth and an expanding customer base, the institution surpassed 1 million active accounts in under a decade, establishing itself as a benchmark for innovation, customer proximity and the digital transformation of the UK banking sector.

Challenge

In 2018, Metro Bank faced a scenario of rapid expansion and an exponential increase in data volume, internal communications and digital transactions. This led to three major strategic challenges:

- Security and compliance – the need to enhance protection against advanced threats (malware, phishing and ransomware) while ensuring full adherence to GDPR and other UK financial sector regulations.

- Governance and device management – the growth of a distributed workforce and mobile device usage required granular control and centralised access and compliance policies.

- Scalable collaborative productivity – the need to modernise the productivity stack with integrated, secure tools, replacing fragmented legacy solutions.

Architecture and Technical Execution

CS GLOBAL IT ☁ was selected as a strategic partner to lead the project, which involved deploying Microsoft 365 E3 for over 1,000 users, combining productivity, security and governance in a single ecosystem. The project was divided into five main phases, spanning a total of 14 weeks:

Phase 1 – Assessment and Strategic Planning

- Comprehensive survey of the legacy environment, mapping over 70 on-premises Exchange email servers.

- Compliance audit and risk assessment focused on GDPR, PCI DSS and ISO 27001.

- Development of a hybrid migration plan with temporary coexistence and zero downtime.

Phase 2 – Microsoft 365 E3 and Azure AD Provisioning

- Creation of a dedicated tenant integrated with Azure Active Directory Premium P1.

- Application of conditional access policies, MFA and synchronisation via Azure AD Connect.

Phase 3 – Exchange Migration and ATP Configuration

- Migration of over 3 TB of email data using Exchange Online Hybrid Configuration Wizard.

- Implementation of Microsoft Defender for Office 365 (ATP) with Safe Links, Safe Attachments and anti-spoofing policies.

- Creation of customised DLP policies for sensitive data (IBAN, PII).

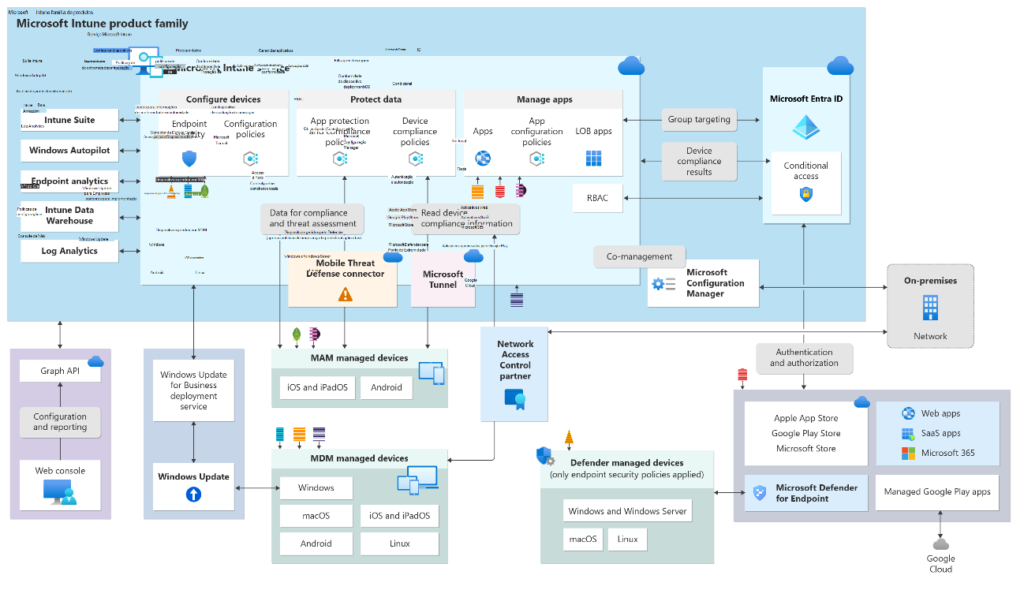

Phase 4 – Devices and Mobility with Intune

- Integration with Microsoft Intune for unified management of Windows, macOS, iOS and Android devices.

- Compliance policies, mandatory encryption and corporate containers for BYOD.

Phase 5 – Continuous Security and Governance

- Integration with Microsoft Secure Score and Security & Compliance Center.

- Alert dashboards connected to the SOC and creation of automated playbooks for incident response.

Results and Strategic Insights

The delivery of the project positioned Metro Bank as a secure, agile and compliant digital player in the UK banking market. The key outcomes achieved include:

- Over 1,000 users migrated in under 90 days with no operational downtime.

- 82% reduction in phishing and malware incidents within the first six months.

- Full compliance with GDPR and PCI DSS.

- 100% of devices managed through Intune.

- 63% reduction in average incident response time.

Strategic Insights

- The combination of Azure AD P1 + Intune + Defender for Office 365 creates a highly effective Zero Trust ecosystem.

- The use of DLP policies based on banking standards significantly mitigates regulatory risks.

- The native security layer of Microsoft 365 reduces dependency on third-party tools.

- End-user experience was preserved through adaptive policies and modern authentication.

Conclusion

The Microsoft 365 E3 deployment was not just a technology upgrade, it was a strategic enabler of Metro Bank’s digital future. The project delivered measurable improvements in security, compliance, and operational efficiency while ensuring a seamless user experience. This initiative solidified Metro Bank’s position as an innovative, customer-centric institution ready to scale in a highly regulated and competitive financial environment.